The £4.8bn Nationwide Pension Fund has been investing in alternative assets for more than a decade. Chief investment officer, Mark Hedges, talks to Sebastian Cheek about making the most out of private markets and how to pick managers, as well as his approach to managing scheme liabilities.

“We try to find opportunities that are maybe a bit more complex than the norm because we think illiquidity and complexity can add value.”

Mark Hedges

Can you give a brief outline of the schemes you manage money for?

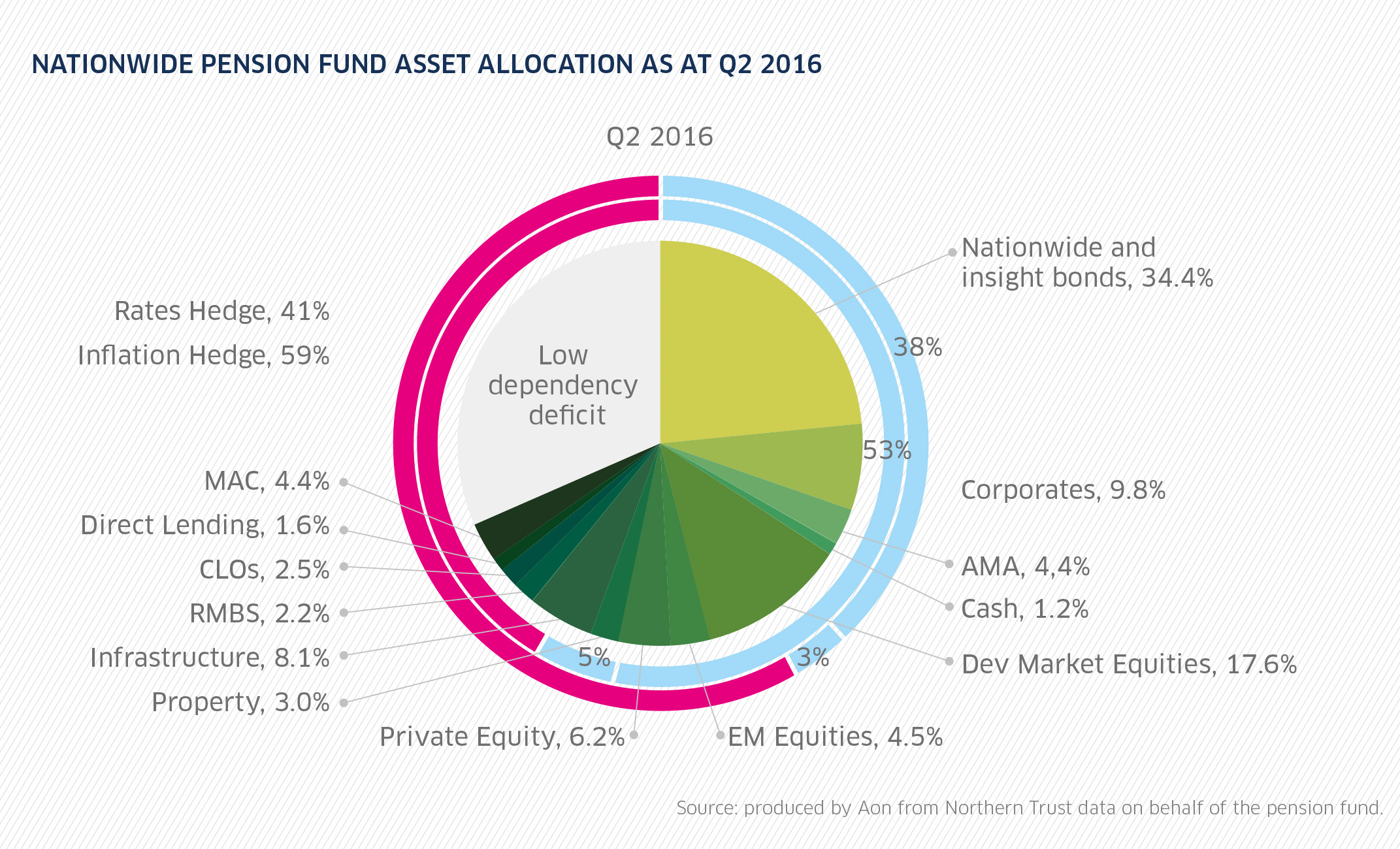

The main Nationwide Pension Fund is about £4.8bn to £4.9bn at the moment, but we also have a smaller scheme, the Cheshire and Derbyshire (C&D) section, which is £320m. The two schemes sit under the Nationwide Pension Fund, but the C&D is a ring-fenced pool so it has its own assets but they’re completely ring-fenced and protected.

It would be fair to say the Nationwide Pension Fund is a seasoned investor in alternatives. How do you go about choosing investments?

Well, we don’t choose things to be interesting; we try to choose things that meet the long-term objectives of the pension funds. We try to find funds and opportunities that are slightly different, maybe a bit more complex than the norm, because we think illiquidity and complexity can add value.

There’s a balance there because there are a lot of interesting things, but often they’re too niche or too small. We just feel uncomfortable with that, because we can’t really participate in a way that would make them meaningful to the fund. For example, some funds may just be raising £100m and we typically want to put £30m to £50m to work, particularly in private markets, and given the size of the fund, it’s not really that meaningful if we do smaller than that. But we don’t want to be more than 10% of a fund, because we don’t really want to be too exposed. That cuts out a lot of things.