Investors have increasingly been entering new asset classes in their search for yield. But is this journey taking them into pre-crisis territory once more? Sebastian Cheek investigates.

“There are investment products out there that have more leverage than we think. In the fixed income space we are seeing loans on loans; strategies that lend money and are then being levered up.”

Himanshu Chaturvedi, Cambridge Associates

The reach for yield is nothing new. Investors across the globe have been forced into new asset classes to deal with a backdrop of low interest rates, loose central bank monetary policy, and now the threat of inflation and heightened political risk.

Traditional assets, particularly in the fixed income space, have become overvalued and lost their lustre and so in order to close expanding funding gaps, investors have had to either work their existing assets harder or look to new forms of income.

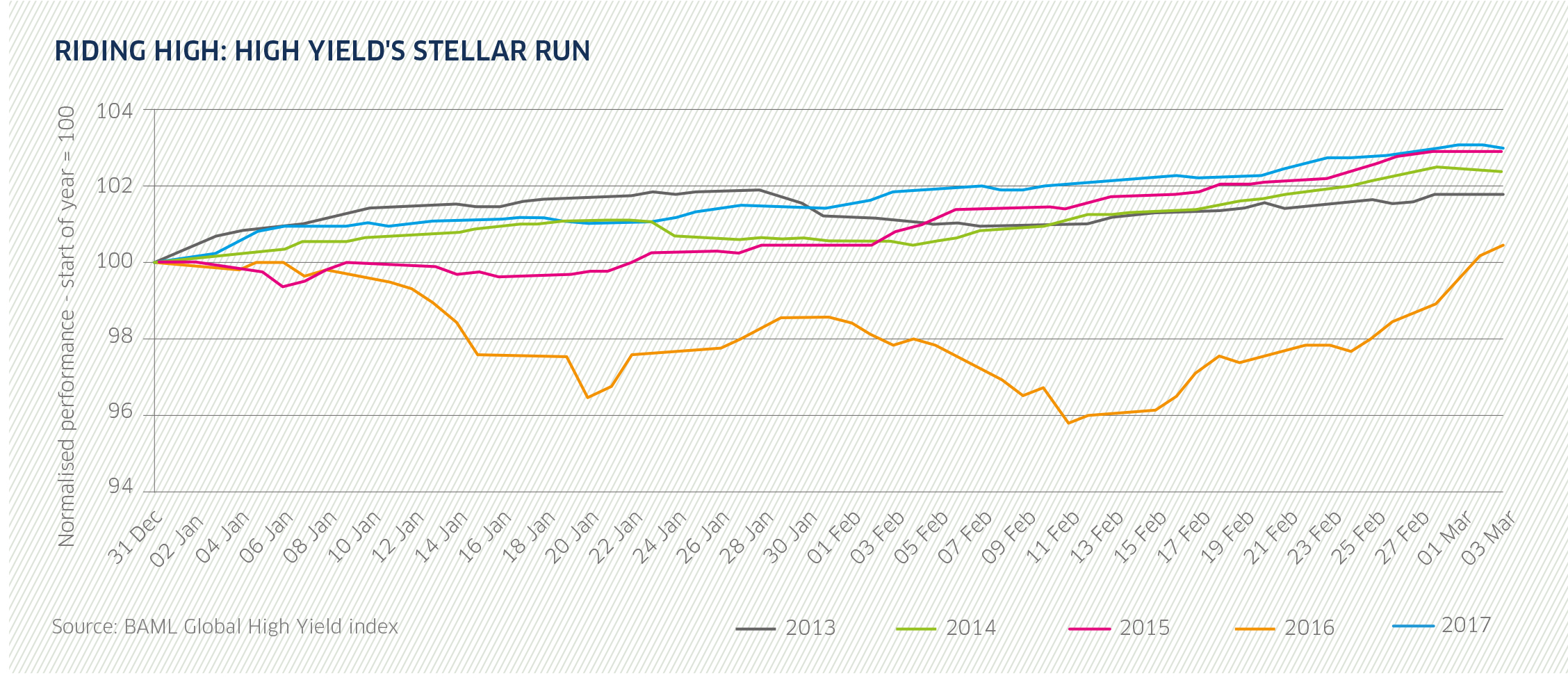

This has meant moving up the risk curve into higher yielding, illiquid securities sometimes carrying higher leverage. Popular choices among institutions include high yield bonds, infrastructure and private market assets such as direct lending and leveraged loans.

Peter Martin, a former investment consultant and now investment officer at the Medical Defence Union, aired concern over this market dynamic at a recent portfolio institutional event.

“These days it’s all about trying to generate some return from somewhere in a sensible risk fashion, but not be pandering to fashion and trying to avoid [a situation where] ‘God forbid it’s 2006 again’,” he said. “The more I see of it, the more concerned I am about people pushing the envelope and taking the risk too far in the lower-for-longer tight credit spread environment.”