Fiduciary management: ‘the tip of a very dangerous iceberg’

The speed and success with which consulting firms have offered fiduciary management services have caused alarm and concern in equal measure. We asked asset managers for their view.

Fiduciary management has become hugely popular with UK pension schemes over a relatively short period of time. As of December 2015, total pension scheme assets managed under full and partial fiduciary management arrangements totalled more than £100bn.

Consultants continue to have the most mandates, and this has caused alarm among asset managers who have watched them expand their traditional role of ‘gatekeeper’ and rapidly eat into their territory. It is not just a matter of sour grapes, however; there are genuine concerns over potential conflicts of interest when a consultant is recommending its own funds to clients.

Research by KPMG does little to allay these fears, with just 23% of new fiduciary appointments in 2015 advised by an independent third party and only 13% of schemes using an independent provider to monitor their FM mandate once it is in place.

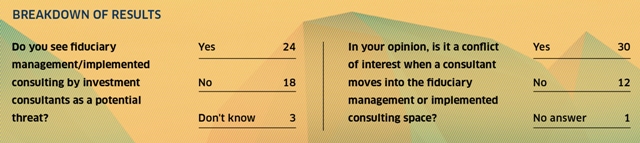

Our research echoed these claims, with more than half of the 43 asset managers interviewed regarding fiduciary management offered by investment consultants as a threat to their business, with two thirds warning over potential conflicts of interest.

Some 55% of the asset managers we spoke to said they believed the continuing growth of implemented consulting, delegated investing, outsourced CIOs and other forms of fiduciary management was eating into their territory.

Furthermore, 70% of respondents felt there was a conflict of interest risk when a consultant moved into the fiduciary management or implemented consulting space.

“How can a consultant be impartial when looking at a DGF or MAC fund if they have their own offering, which they are massively incentivised to sell?” said one respondent.

“That is just the tip of a very big and dangerous iceberg.”

Another respondent said it was “an obvious conflict of interest and a way for them to increase profit margins.”

Others were more sanguine, believing while the potential for conflict existed, it could be managed effectively.

“It is certainly a conflict because there is an incentive to transition clients into the fiduciary offering as it is more profitable and scalable,” said one respondent. “However, if the conflicts are managed effectively it is possible to offer fiduciary services to those clients that are suited to such a model while maintaining high quality traditional advisory services for those clients wishing to retain more direct control.

“The growth of fiduciary management is certainly changing the dynamics of the relationship between consultants and asset managers.”