24 Apr 2024

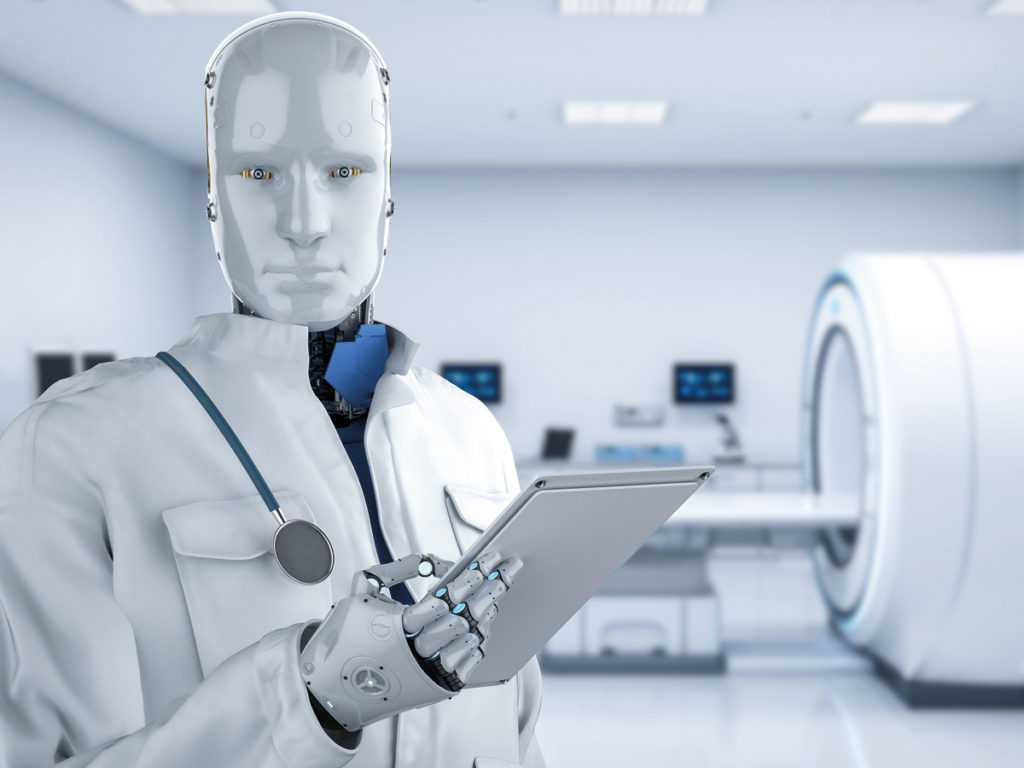

ESG: The robot will see you now

With rising diagnosis of chronic conditions putting pressure on developed world economies, how can investors get people off the sick list? Mark Dunne reports.

16 Apr 2024

16 Apr 2024

9 Apr 2024

9 Apr 2024

27 Mar 2024

27 Mar 2024

26 Mar 2024

26 Mar 2024

The chief investment officer of the Lothian Pension Fund (LPF) talks about being on a learning curve, having a clear strategy, managing assets in-house, a 20-year track record in infrastructure and having an open-door policy. Andrew Holt met him.

24 Apr 2024

24 Apr 2024

12 Apr 2024

12 Apr 2024

Sign up to the portfolio institutional newsletter to receive a weekly update with our latest features, interviews, ESG content, opinion, roundtables and event invites. Institutional investors also qualify for a free-of-charge magazine subscription.